You can conquer your credit score

What is a credit score?

Your credit score reflects how reliable you are with money. It's a number between 300 and 850 that lenders use to judge your financial trustworthiness. A good score can open doors to lower interest rates, better loans and more opportunities.

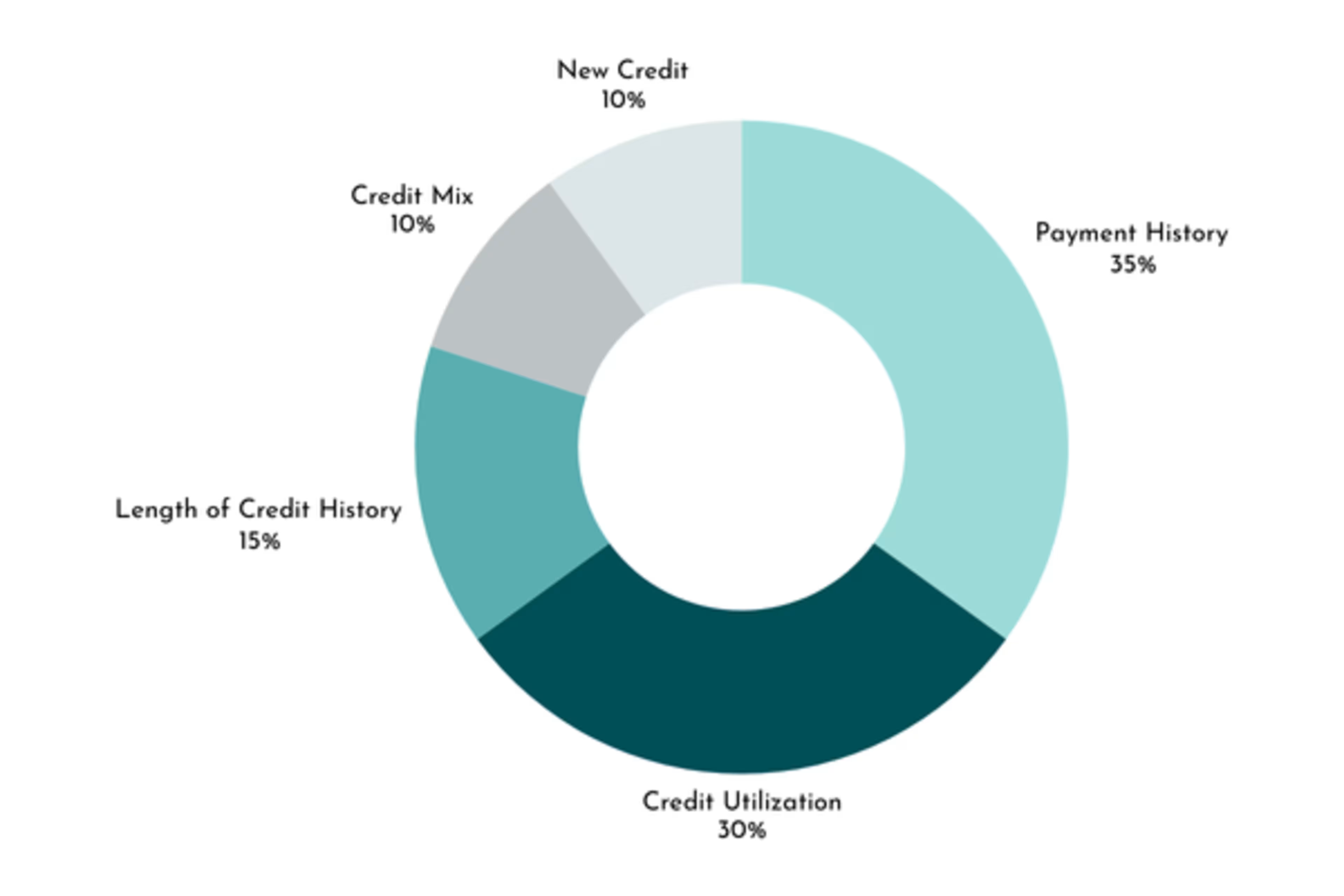

What impacts your score?

Your credit score is made up of five main factors. The largest piece is your payment history — making on-time payments is crucial. Next is credit utilization, or how much of your available credit you use. Length of credit history shows how long you've had accounts open, while your credit mix looks at the variety of credit types you use. Lastly, new credit inquiries can slightly lower your score.

Source: Experian

What if my credit has bumps and bruises?

Don’t worry — many people have credit challenges at some point. The good news is, credit scores can improve over time. Focus on paying bills on time, lowering credit card balances and avoiding new debt. Even small, consistent steps can make a big difference. It’s never too late to rebuild your credit!

Frequently asked questions about credit

Closing a credit account can impact your score in two ways:

Credit utilization If you close a card with a high credit limit, your total available credit decreases, which can raise your utilization ratio (how much credit you're using vs. what's available).

Length of credit history Older accounts help build a longer credit history. Closing them may shorten your average account age, which can slightly lower your score.

Tip: If the account doesn’t have an annual fee, consider keeping it open to maintain your credit history and utilization ratio.

Credit utilization is the percentage of your available credit that you're currently using. It makes up about 30% of your credit score. For example, if you have a $10,000 credit limit and carry a $3,000 balance, your utilization is 30%. Experts recommend keeping utilization below 30%, and ideally under 10% for optimal scoring.

A hard inquiry occurs when a lender checks your credit during a loan or credit card application. It can lower your score by a few points and stays on your report for up to two years, though its impact typically fades after a few months. Multiple hard inquiries in a short time can signal risk to lenders, especially if you're applying for several credit lines at once.

Hard inquiries affect your score and happen when you apply for credit.

Soft inquiries do not affect your score and occur when you check your own credit or when lenders preapprove you for offers.

Monitoring your credit regularly with soft inquiries is a smart way to stay informed without hurting your score.

Most negative marks stay on your credit report for:

Late payments Up to seven years from the missed payment date.

Collections Up to seven years from the original delinquency.

Bankruptcies 7 – 10 years, depending on the type. Positive information, like on-time payments and paid-off loans, can remain for 10+ years, helping your score long-term.

There’s no perfect number, but having a mix of credit types — like credit cards, auto loans, and mortgages — can help your score. Lenders like to see that you can manage different types of credit responsibly. Just be cautious not to open too many accounts at once, which can lower your average account age and trigger multiple hard inquiries.

Not always. The three major bureaus — Equifax, Experian and TransUnion — may have slightly different data depending on which lenders report to them. That’s why your score can vary across bureaus. Most lenders use FICO® scores, but some use VantageScore®, which may also cause differences.

Yes! Rebuilding credit takes time, but it’s absolutely possible. Start by:

Making on-time payments consistently

Paying down debt to lower your utilization

Avoiding new hard inquiries unless necessary

Considering a secured credit card or credit builder loan

Monitoring your credit report for errors and disputing inaccuracies

Build Your Credit Confidence — Then Keep Going

*The information provided on this website and within Westerra Credit Union’s financial education resources is for educational and informational purposes only. It is not intended to provide, and should not be construed as, financial, investment, tax, legal, or healthcare advice.Westerra Credit Union does not offer or provide guidance on individual tax situations, legal matters, or healthcare decisions. You should consult with a qualified financial advisor, tax professional, attorney, or healthcare professional for advice specific to your personal circumstances.While we strive to ensure the accuracy and timeliness of the information presented, Westerra Credit Union makes no guarantees or warranties, express or implied, regarding the completeness, reliability, or suitability of any information, products, or services referenced herein.Your use of this website and participation in any financial education materials or programs signifies your acknowledgment and agreement that Westerra Credit Union is not liable for any losses or damages that may arise from reliance on the information provided.